Running a successful construction business involves more than having the expertise to complete projects efficiently. Behind the scenes, tackling administrative tasks such as managing Payroll and tax obligations can be an overwhelming undertaking. These complex procedures are vital for maintaining the health of your firm, ensuring compliance with regulations, and preserving the satisfaction of your workforce.

This blog explores, in-depth, the perfect payroll solutions for contractors, focusing on managing tax deposits and filings.

Our goal is to streamline your processes, help you avoid common pitfalls, and free up your time so you can focus on your core competency: building outstanding structures.

Importance of Efficient Payroll Tax Deposits and Filings for Contractors

Proper handling of payroll tax deposits and filings is critical for numerous reasons. Contractors are legally obligated to deposit and file payroll taxes promptly and correctly. Failing to comply with these regulations can lead to significant fines, penalties, and increased scrutiny from tax authorities.

Moreover, keeping your payroll tax deposits and filings organized can lead to improved cash flow for your business. It allows for better financial forecasting and minimizes the chance of unwanted surprises in the form of hefty tax bills.

Benefits of Streamlining These Processes

There are numerous benefits to streamlining your payroll tax operations -

- Reducing administrative burden: An efficient system frees up your time, allowing you to focus on the core aspects of your business.

- Minimizing errors: Streamlined procedures reduce the likelihood of errors, helping to avoid costly fines and penalties.

- Enhancing compliance: A streamlined system ensures that all tax deposits and filings are made accurately and promptly, reducing risk.

- Improving business efficiency: Efficient processes can significantly improve the overall operation of your business.

- Enhancing employee satisfaction: Correct and timely payroll accounting and tax deposits foster trust and satisfaction among employees.

Understanding Payroll Tax Deposits

Explanation of Payroll Tax Deposits

Before diving into payroll solutions for contractors, it's crucial to define payroll tax deposits. Essentially, these are taxes withheld from employees' wages, which employers must pay to the government. For contractors, this typically includes withheld federal income tax and contributions to Social Security and Medicare (FICA taxes). In some instances, state and local taxes may also apply.

Importance of Accurate and Timely Payroll Tax Deposits

Being accurate and vigilant with tax deposit management is crucial for contractors for a few reasons:

- Timely and accurate payroll tax deposits reduce the risk of penalties and interest the government charges for late or incorrect payments.

- They help maintain cash flow and financial stability in your business, as delayed payments can lead to large, unexpected expenses.

- Accurate payroll tax deposits protect your reputation, fostering trust among employees and clients.

Different Types of Payroll Taxes That Contractors Need to Deposit

Contractors are subject to various payroll taxes, which vary based on federal and state laws. These include:

- Withheld Federal Income Tax: The employer withholds this tax from the employee's wages and deposits it with the federal government.

- Social Security and Medicare Taxes (FICA): These are also withheld from employee wages and matched by employers.

- Federal Unemployment Tax (FUTA): This tax is not deducted from employee wages but is paid by employers.

- State Unemployment Tax (SUTA): Like FUTA, this is typically paid by employers, although some states also require an employee contribution.

- Specific local taxes: Certain municipalities and counties levy their own payroll taxes that must be deducted and deposited accordingly.

Keep in mind that the above list is an overview and not exhaustive - certain circumstances might require additional deposits.

Tips for Efficient Payroll Tax Deposits

By streamlining your payroll tax deposits as a contractor, you can significantly reduce the effort required to process these and the potential for errors.

Here are four tips to help you optimize your payroll tax deposits -

Tip 1: Understanding your payment schedule and due dates

The very first step to efficient payroll tax deposits is having a thorough understanding of your payment schedule and due dates. Failure to deposit your taxes in a timely manner can result in burdensome penalties.

- Understand the deposit requirements for both Federal and State payroll taxes.

- Stick to a well-planned schedule for depositing taxes, typically either monthly or semi-weekly.

- Mark due dates on your calendar to avoid missing any payments.

Tip 2: Using electronic payment methods for faster and more accurate deposits

Using electronic methods for your tax deposits can significantly streamline your process. Electronic deposits are not only faster but also reduce the risk of lost or delayed payments, especially compared to traditional mail.

- Use the Electronic Federal Tax Payment System (EFTPS) for federal taxes

- Check if your state accepts electronic payments and utilize this method if available

Tip 3: Keeping detailed records and documentation of payroll tax deposits

It is important to maintain a well-organized record of all your payroll tax deposits. This can save you a lot of time and trouble in future disputes or audits.

- Keep copies of all payment confirmations and receipts

- Record the date, amount, and destination of each tax deposit

Tip 4: Utilizing payroll software or outsourcing to a payroll service provider

Construction payroll can get complicated. Using a payroll software solution or outsourcing to a payroll service provider can save you a lot of headaches.

- Look at payroll solutions specially designed for contractors that can handle complex tax calculations.

- If payroll processing is taking too much of your time, consider hiring a trusted payroll service provider.

Streamlining Payroll Tax Filings

For contractors, streamlining payroll tax filings is not merely an administrative duty but rather an essential task to ensure business efficiency and compliance with laws and regulations.

Payroll tax filings are the mandatory reports that contractors must submit to the government, detailing the total amounts of wages paid and taxes withheld from their employees. This process involves not only preparing and submitting the correct forms but also reconciling these figures with your business accounts and ensuring that the corresponding payments have been deposited to the relevant tax authorities on time.

Importance of accurate and timely payroll tax filings

Accurate and timely payroll tax filing is crucial to avoid unnecessary penalties or interest charges from the IRS. More broadly, it helps ensure healthy cash flow, administrative efficiency, and positive relations between contractors and their employees, as well as with tax authorities.

Here are some points to consider:

- Consistent accuracy ensures you deposit the correct amount of tax.

- Timely filings prevent late submission penalties.

- Properly filing reduces the internal stress of potential audits.

Different types of payroll tax forms for contractors

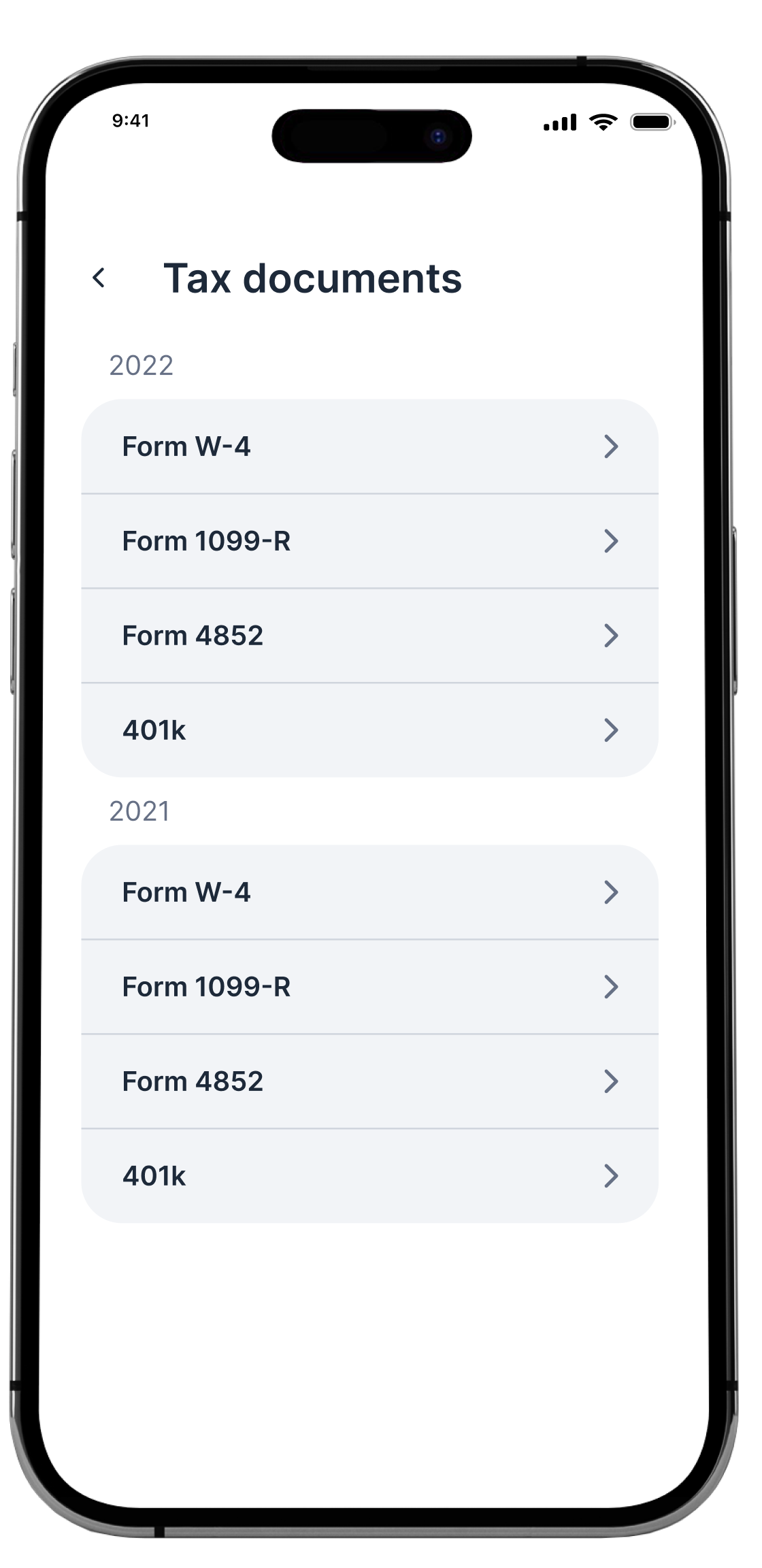

The types of payroll tax forms required for contractors can vary, but the most common ones include:

- Form 941 (Employer's Quarterly Federal Tax Return): reports federal withholdings from employees.

- Form 940: reports the annual Federal Unemployment Tax Act (FUTA) tax.

- Form W2 and W3: provide a year-end summary of wages paid and taxes withheld.

- Form 1099-NEC: for reporting payments to non-employee contractors.

Tips for Simplified Payroll Tax Filings

Dealing with payroll tax filings can indeed be daunting, especially for contractors. However, the process can be simplified and streamlined by following some crucial tips.

Tip 1: Organizing and Maintaining Accurate Payroll Records

A critical step towards simplified tax filings is ensuring your payroll records are well organized and accurate. This involves maintaining an up-to-date record of all your employees' personal and financial information, including -

- Personal details like names, social security numbers, addresses, tax reports, previous payslips, and insurance coverage.

- Worker classification, Salary information, including hourly wages or annual salaries, overtime, bonuses, and deductions.

Inconsistencies in these details can lead to errors in your filings, resulting in penalties.

Tip 2: Using Payroll Software or Outsourcing for Automated Calculations and Form Submissions

Automating your payroll process can eliminate the chance of human error and save valuable time. Many payroll software solutions come integrated with features like automatic tax calculations, tax form submissions, and alerts for upcoming tax deadlines, which can ease your payroll responsibility.

Tip 3: Staying Updated with the Latest Tax Laws and Regulations

Tax laws and regulations are continually changing. As a contractor, staying abreast of these changes can save you from unexpected fines. Consider subscribing to tax law update newsletters and joining contractor or business forums for reliable, up-to-date information.

Tip 4: Seeking Professional Help or Consulting with a Tax Advisor

Finally, seeking professional help can be invaluable. Tax advisors or certified public accountants provide professional advice and can keep you informed about the nuances of the tax world. By doing so, they can help ensure your payroll tax filings are accurate and timely. Investing in such professional advice can offer you peace of mind and allow you to focus on your core contracting operations.

How to Choose the Right Payroll Software for Your Business?

When it comes to choosing the ideal payroll software tailored specifically for contractors' unique needs, it's important to factor in certain aspects. Consider criteria such as integration with digital time tracking applications, automated Payroll, certified Payroll, tax calculation, payment handling, and report generation.

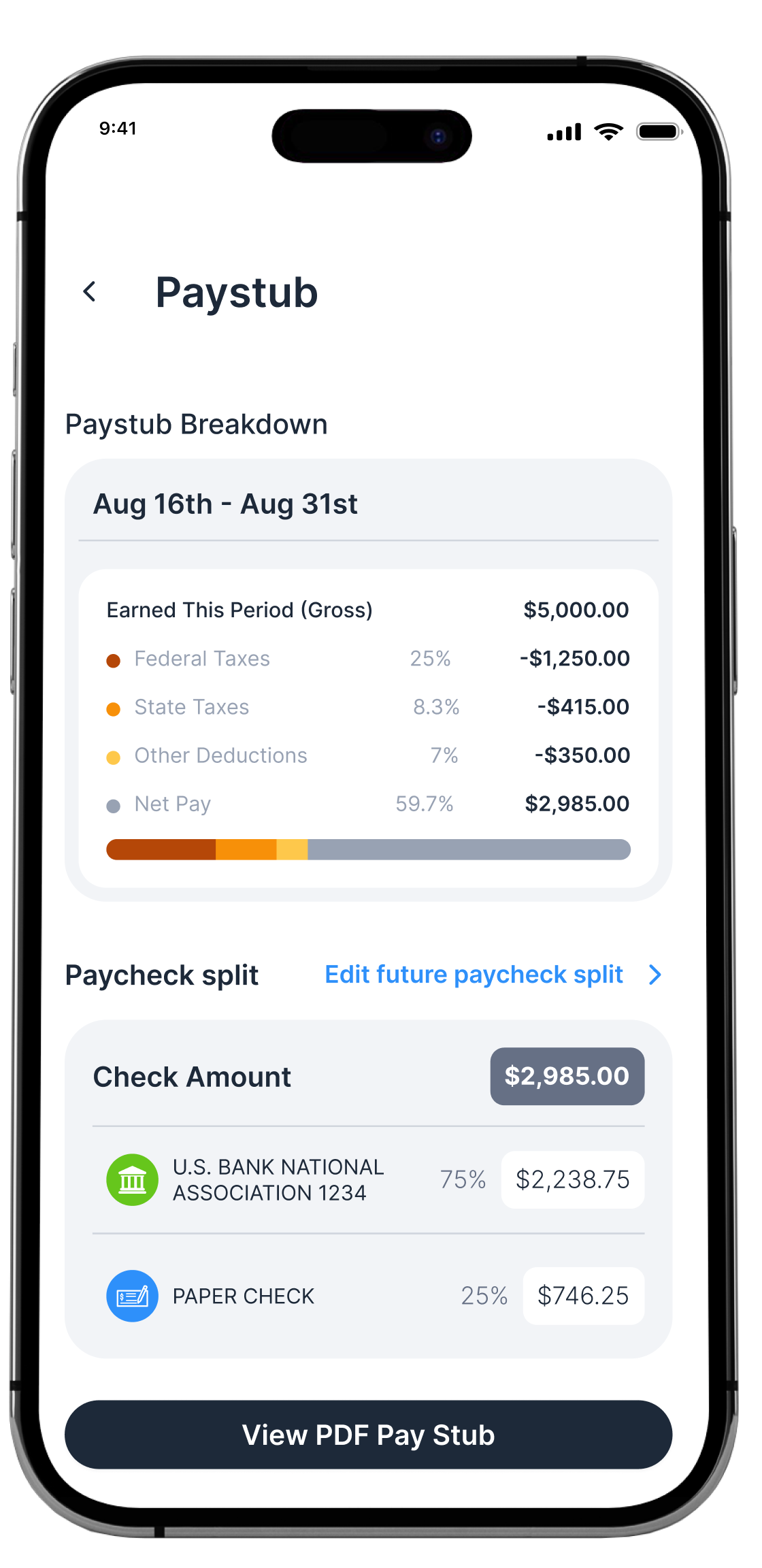

Payroll applications like Lumber also go the extra mile and allow you to pay employees through the platform.

There are numerous service providers out there who specialize in contractor payroll management. They have an in-depth understanding of the nuances associated with the contractor's payroll accounting. Companies like QuickBooks, Square Payroll, and Gusto are some of the top picks, offering intuitive, friendly payroll solutions tailored for contractors.

Benefits of utilizing payroll solutions for contractors

Implementing payroll applications designed for contractors yields multiple benefits. These applications reduce the manual effort involved, are more accurate in wage calculations, and help you achieve compliance without breaking a sweat. These purpose-built applications help contractors to focus on their core business aspects.

Moreover, with a contractor-centric payroll system, the documentation process is made simpler, which can be a boon during tax filing seasons. Thus, investing in a construction payroll system can be a wise business move for contractors.

Top Contractors Payroll Solutions

Finding the right solution for managing contractors' Payroll can be simplified by choosing reliable software.

Here are five top-notch platforms that stand out in the construction industry.

List Top Five Construction Payroll Solutions

- Lumber: This solution seamlessly integrates Payroll, job costing, and project management, easing the complexity of construction payrolls by automating prevailing wage rates and union fringes. With compliance baked into the product, Lumber leverages AI to ensure that its users are compliant with complex labor laws and rules. Lumber payroll not only integrates with Lumber Time Tracking but also with other time tracking software used in the industry. It also provides end-to-end payment features, allowing you to pay your subcontractors securely through the platform.

- ADP: Automatic Data Processing (ADP) is a cloud-based human capital management (HCM) solution that handles Payroll, HR, and talent management. Their comprehensive payroll service covers everything from calculating tax withholdings to administering payslips. ADP is the most popular payroll service used by most contractors, but on the flip side, this application is not custom-built for construction companies.

- Payroll4construction: A custom-built application for the construction industry, Payroll4Construction makes payroll calculations easy and provides features like certified Payroll, union wages, automated reports, and more.

- eBacon: eBacon is a construction application that provides Payroll, time tracking, and HR management in one platform. Where Payroll is concerned, this application offers tax management, time management, certified Payroll, and prevailing wage calculations for Federal projects under Davis Bacon compliance rules.

- Quickbooks: Quickbooks is a generic payroll solution not custom-built for construction. It provides a comprehensive set of features that allows you to set up payroll processes. It provides unlimited payroll runs, Automated calculation, filing, and payment of federal and state taxes, and robust reporting. On the flip side, this application is expensive, and the time-tracking feature is available only for top-tier plans.

Each of these top contractor payroll solutions can effectively manage tax deposits and filings, making Payroll a stress-free process.

Streamlining payroll tax deposits and filings is a crucial aspect of contractor businesses, often fraught with several challenges. Leveraging innovative payroll solutions such as Lumber can provide a fitting answer to these obstacles.

Lumber is purpose-built for construction, and with compliance baked into its DNA, it keeps contractors like yourself on the right side of the law.

Here are five reasons why you should choose Lumber over others -

1. Accurate Wage Calculations: Lumber Payroll integrates with other popular time-tracking applications and also offers its own time-tracking platform to its customers. Integrations such as these eliminate much manual work and data entry. The result is accurate wage calculations through precise time tracking.

2. End-to-end Payment: One of the biggest advantages of Lumber is that it allows you to pay your employees securely through the platform. This eliminates unwanted delays and ensures that your payments are up-to-date.

3. Compliance made easy: There are many labor-related rules and regulations for contractors to follow, and with Lumber, it becomes easy to achieve compliance. Lumber Payroll ensures native compliance for Certified Payroll, Construction Timesheet, Union Reporting, and Prevailing Wages provides robust reporting features.

4. Tax Calculations: With Lumber Payroll at the helm, tax calculations for 50+ US states become easy and simple.

5. AI Chat Interface: For the first time, you can actually chat with your payroll and process payments without any hassles.

By keeping these effective payroll solutions in mind, construction contractors can guarantee not only a seamless process but also the minimization of errors. Any potential nuances in tax deposits and filings can be confidently addressed, facilitating a smoother operation, enhancing productivity, and promoting business growth in the competitive construction industry.

So, the next time payroll taxes seem insurmountable, remember it is as simple as embracing these solutions to manage the necessary tax deposits and filings proficiently and stress-free, leaving you more time to focus on the actual construction work that is your specialty.