Understanding the Differences Between 1099-NEC and 1099-MISC

Construction companies frequently struggle with determining whether to use Form 1099-NEC or 1099-MISC when reporting contractor payments. The IRS created these two separate forms to streamline tax reporting and reduce confusion about different payment types. In 2020, the IRS reintroduced Form 1099-NEC specifically for non-employee compensation, while Form 1099-MISC continued to handle miscellaneous income categories. Understanding when to use 1099 nec vs 1099 misc is crucial for construction companies to maintain compliance and avoid costly penalties.

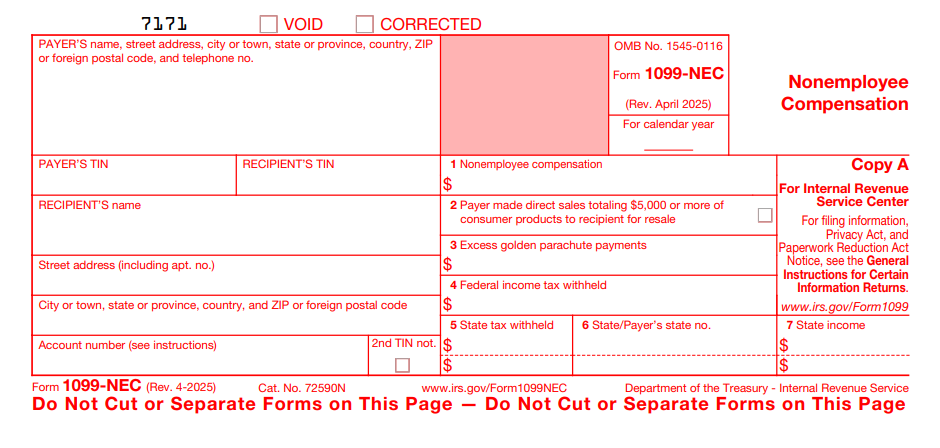

What is IRS Form 1099-NEC?

Form 1099-NEC (Nonemployee Compensation) was reintroduced by the IRS in tax year 2020 after being discontinued in 1982. This form specifically reports payments made to independent contractors, freelancers, and other non-employees who provided services to your construction business.

Construction companies must issue Form 1099-NEC when they pay $600 or more during the tax year to:

- Subcontractors performing construction work

- Independent contractors providing specialized services

- Freelance professionals like architects or engineers

- Non-corporate entities that performed services

The form includes a single box (Box 1) for reporting nonemployee compensation, making it straightforward for construction companies to report contractor payments. Payments to corporations typically don't require 1099-NEC filing, with some exceptions for legal services and medical payments.

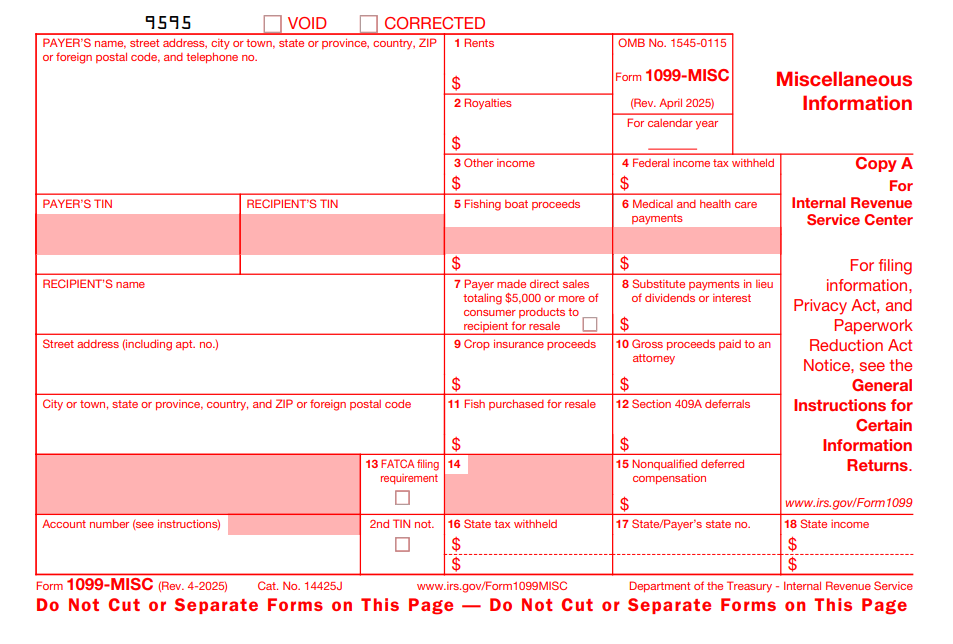

What is IRS Form 1099-MISC?

Form 1099-MISC (Miscellaneous Information) now serves as the catch-all form for various income types that don't qualify as nonemployee compensation. Following the 1099-NEC vs. 1099-MISC split, Form 1099-MISC handles several specific payment categories relevant to construction companies.

Construction businesses use Form 1099-MISC to report:

- Box 1: Rents paid to property owners or equipment rental companies ($600 or more)

- Box 2: Royalties paid for use of intellectual property ($10 or more)

- Box 3: Other income payments not covered by other forms

- Box 5: Fishing boat proceeds

- Box 6: Medical and healthcare payments to physicians and healthcare providers

- Box 7: Nonemployee compensation to attorneys (legal settlements and fees)

- Box 8: Substitute payments in lieu of dividends or interest

- Box 10: Crop insurance proceeds

- Box 12: Section 409A deferrals

- Box 14: Excess golden parachute payments

Difference Between Form 1099-NEC and Form 1099-MISC

Understanding the differences between 1099-NEC and 1099-MISC helps construction companies choose the correct form for each payment situation.

Key Differences

When to Use 1099-NEC vs MISC

Use Form 1099-NEC when:

- Paying subcontractors for construction services

- Compensating independent contractors

- Making payments to non-corporate service providers

- The payment represents compensation for services performed

Use Form 1099-MISC when:

- Paying rent for construction sites or equipment

- Making legal settlement payments

- Paying attorneys for legal services

- Reporting royalties or other miscellaneous income

Who Gets a 1099-MISC vs NEC

The recipient type determines what is 1099 misc vs nec:

1099-NEC Recipients:

- Individual contractors and subcontractors

- LLCs taxed as partnerships or sole proprietorships

- Partnerships providing services

- Non-corporate entities performing work

1099-MISC Recipients:

- Property owners receiving rent payments

- Equipment rental companies

- Attorneys receiving legal fees

- Healthcare providers (for medical payments)

- Any entity receiving qualifying miscellaneous income

How to File Forms 1099-NEC and 1099-MISC

Both forms follow similar filing procedures, but construction companies must ensure they select the appropriate form based on the payment type.

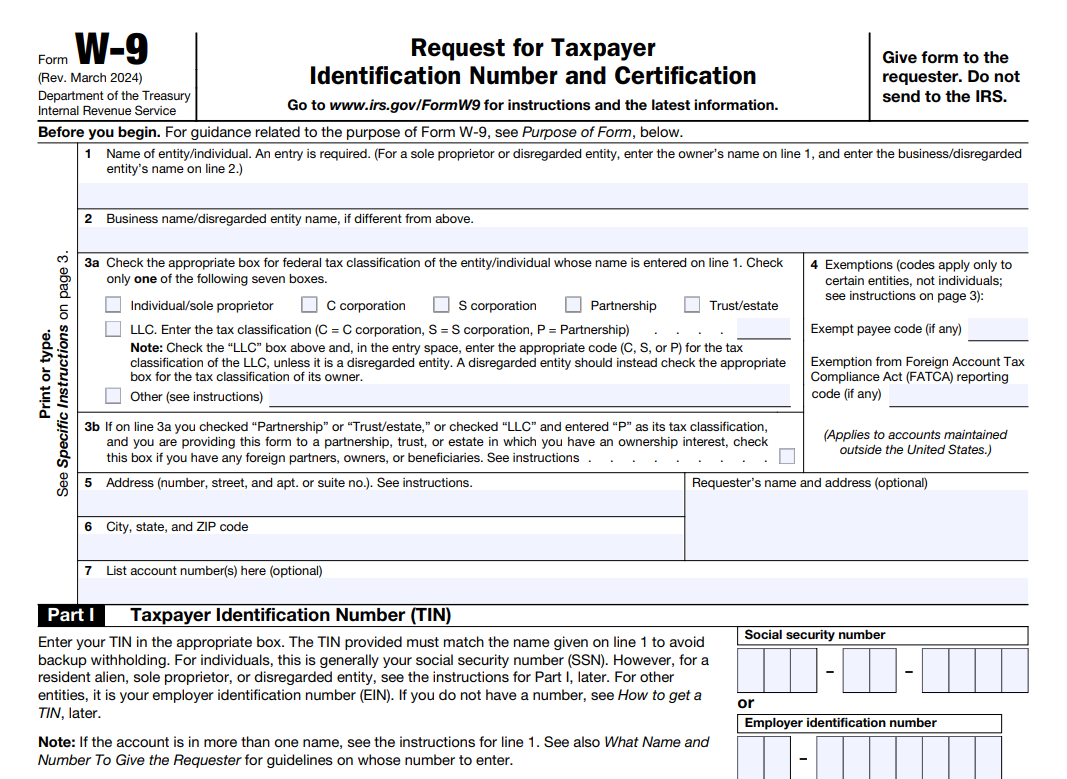

Step-by-Step Filing Process

- Collect Form W-9: Obtain completed Form W-9 from all contractors and vendors before making payments. This form requires the taxpayer's identification number (TIN) and the correct legal name.

- Determine the Correct Form: Analyze each payment to determine when to use 1099 NEC vs Misc:

- Service payments = 1099-NEC

- Rent, legal fees, or other miscellaneous income = 1099-MISC

- Complete Form Details: Enter payer information (your construction company), recipient details, and payment amounts in the appropriate boxes.

- Prepare Copies: Create copies for the IRS (Copy A), the recipient (Copy B), and your records (Copy C).

- Distribute and File: Send recipient copies by January 31 and file with the IRS by the same deadline.

How Do You Submit 1099-NEC and 1099-MISC to the IRS

Construction companies have multiple options for submitting these forms to the IRS.

Electronic Filing Options

IRS Filing Information Returns Electronically (FIRE) System:

- Free system for businesses filing up to 250 forms

- Requires registration and approval process

- Supports both 1099-NEC and 1099-MISC submissions

Third-Party Payroll Services:

- QuickBooks, ADP, Paychex, and similar platforms

- Automated form generation and filing

- Integration with existing payroll systems

Tax Preparation Software:

- Professional tax software with 1099 filing capabilities

- Suitable for smaller construction companies

- Often includes compliance checking features

Paper Filing

Construction companies filing fewer than 250 forms annually can submit paper copies to:

Internal Revenue Service

Austin, TX 73301

Include Form 1096 (Annual Summary and Transmittal) when filing paper forms.

Electronic Filing Requirements

Businesses filing 250 or more information returns are required to file electronically. This threshold applies to the combined total of all information returns, including both Form 1099-NEC and Form 1099-MISC.

1099-NEC and 1099-MISC Deadlines

Both forms share the same critical deadlines for construction companies.

Filing Deadlines

January 31:

- File forms with the IRS

- Provide copies to recipients

- Both deadlines are firm with no extensions available

Late Filing Penalties

The IRS imposes escalating penalties based on how late forms are filed:

- Filed 1-30 days late: $60 per form (maximum $630,000 annually)

- Filed 31+ days late: $110 per form (maximum $1,113,000 annually)

- Not filed by August 1: $290 per form (maximum $3,783,000 annually)

Small businesses (average annual gross receipts of $5 million or less over three years) face lower maximum penalties:

- $220,500 for forms filed 1-30 days late

- $566,500 for forms filed 31+ days late

- $1,921,500 for forms not filed by August 1

Penalty Mitigation

Construction companies can avoid penalties by:

- Maintaining accurate contractor records throughout the year

- Setting up systems to track payment thresholds

- Filing forms early to avoid last-minute issues

- Using electronic filing systems for faster processing

Understanding the differences between 1099-NEC and 1099-MISC is essential for construction companies managing contractor relationships and vendor payments. Form 1099-NEC handles non-employee compensation for subcontractors and independent contractors, while Form 1099-MISC reports miscellaneous income, such as rent and legal fees. Both forms share the same January 31 deadline and carry significant penalties for non-compliance.

Construction companies should implement systematic approaches to determine when to use Form 1099-NEC vs. Miscellaneous, maintain accurate records throughout the year, and consider electronic filing solutions to streamline compliance. Proper form selection and timely filing protect businesses from costly IRS penalties while ensuring accurate tax reporting for all payment relationships.

Frequently Asked Questions

What is the difference between 1099-NEC and 1099-MISC?

The main difference lies in their purpose: 1099-NEC reports non-employee compensation (like subcontractor payments), while 1099-MISC handles miscellaneous income categories, including rent, legal fees, and royalties. Construction companies use 1099-NEC for contractor services and 1099-MISC for equipment rental or legal settlement payments.

Do I need to send both 1099-NEC and 1099-MISC?

You may need to send both forms if you make different types of payments to various recipients. For example, a construction company might send 1099-NEC forms to subcontractors for their services and 1099-MISC forms to property owners for site rental fees. Each payment type requires the appropriate form.

What is the penalty for not filing 1099 forms on time?

Late filing penalties range from $60 to $290 per form, depending on how late you file. The maximum annual penalty can reach $3.78 million for large businesses. Small businesses face lower maximum penalties but should still prioritize timely filing to avoid any financial impact.

Can I file 1099s electronically?

Yes, you can file both 1099-NEC and 1099-MISC forms electronically through the IRS FIRE system, third-party payroll services, or tax preparation software. Electronic filing is required if you file 250 or more information returns annually and often provides faster processing and confirmation of receipt.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec ullamcorper mattis lorem non. Ultrices praesent amet ipsum justo massa. Eu dolor aliquet risus gravida nunc at feugiat consequat purus. Non massa enim vitae duis mattis. Vel in ultricies vel fringilla.

Introduction

Mi tincidunt elit, id quisque ligula ac diam, amet. Vel etiam suspendisse morbi eleifend faucibus eget vestibulum felis. Dictum quis montes, sit sit. Tellus aliquam enim urna, etiam. Mauris posuere vulputate arcu amet, vitae nisi, tellus tincidunt. At feugiat sapien varius id.

Eget quis mi enim, leo lacinia pharetra, semper. Eget in volutpat mollis at volutpat lectus velit, sed auctor. Porttitor fames arcu quis fusce augue enim. Quis at habitant diam at. Suscipit tristique risus, at donec. In turpis vel et quam imperdiet. Ipsum molestie aliquet sodales id est ac volutpat.

Ipsum sit mattis nulla quam nulla. Gravida id gravida ac enim mauris id. Non pellentesque congue eget consectetur turpis. Sapien, dictum molestie sem tempor. Diam elit, orci, tincidunt aenean tempus. Quis velit eget ut tortor tellus. Sed vel, congue felis elit erat nam nibh orci.

Dolor enim eu tortor urna sed duis nulla. Aliquam vestibulum, nulla odio nisl vitae. In aliquet pellentesque aenean hac vestibulum turpis mi bibendum diam. Tempor integer aliquam in vitae malesuada fringilla.

Elit nisi in eleifend sed nisi. Pulvinar at orci, proin imperdiet commodo consectetur convallis risus. Sed condimentum enim dignissim adipiscing faucibus consequat, urna. Viverra purus et erat auctor aliquam. Risus, volutpat vulputate posuere purus sit congue convallis aliquet. Arcu id augue ut feugiat donec porttitor neque. Mauris, neque ultricies eu vestibulum, bibendum quam lorem id. Dolor lacus, eget nunc lectus in tellus, pharetra, porttitor.

Ipsum sit mattis nulla quam nulla. Gravida id gravida ac enim mauris id. Non pellentesque congue eget consectetur turpis. Sapien, dictum molestie sem tempor. Diam elit, orci, tincidunt aenean tempus. Quis velit eget ut tortor tellus. Sed vel, congue felis elit erat nam nibh orci.

Mi tincidunt elit, id quisque ligula ac diam, amet. Vel etiam suspendisse morbi eleifend faucibus eget vestibulum felis. Dictum quis montes, sit sit. Tellus aliquam enim urna, etiam. Mauris posuere vulputate arcu amet, vitae nisi, tellus tincidunt. At feugiat sapien varius id.

Eget quis mi enim, leo lacinia pharetra, semper. Eget in volutpat mollis at volutpat lectus velit, sed auctor. Porttitor fames arcu quis fusce augue enim. Quis at habitant diam at. Suscipit tristique risus, at donec. In turpis vel et quam imperdiet. Ipsum molestie aliquet sodales id est ac volutpat.

Mi tincidunt elit, id quisque ligula ac diam, amet. Vel etiam suspendisse morbi eleifend faucibus eget vestibulum felis. Dictum quis montes, sit sit. Tellus aliquam enim urna, etiam. Mauris posuere vulputate arcu amet, vitae nisi, tellus tincidunt. At feugiat sapien varius id.

Eget quis mi enim, leo lacinia pharetra, semper. Eget in volutpat mollis at volutpat lectus velit, sed auctor. Porttitor fames arcu quis fusce augue enim. Quis at habitant diam at. Suscipit tristique risus, at donec. In turpis vel et quam imperdiet. Ipsum molestie aliquet sodales id est ac volutpat.

- Lectus id duis vitae porttitor enim gravida morbi.

- Eu turpis posuere semper feugiat volutpat elit, ultrices suspendisse. Auctor vel in vitae placerat.

- Suspendisse maecenas ac donec scelerisque diam sed est duis purus.

Lectus leo massa amet posuere. Malesuada mattis non convallis quisque. Libero sit et imperdiet bibendum quisque dictum vestibulum in non. Pretium ultricies tempor non est diam. Enim ut enim amet amet integer cursus. Sit ac commodo pretium sed etiam turpis suspendisse at.

Tristique odio senectus nam posuere ornare leo metus, ultricies. Blandit duis ultricies vulputate morbi feugiat cras placerat elit. Aliquam tellus lorem sed ac. Montes, sed mattis pellentesque suscipit accumsan. Cursus viverra aenean magna risus elementum faucibus molestie pellentesque. Arcu ultricies sed mauris vestibulum.

Critical Construction Compliance | Awareness Week

Mar 16, 2026

Apr 15, 2026

Nov 30, 2026

Dec 15, 2026

Essential resources for contractors