DIR Filing in Construction: A Guide for Contractors

In the complex landscape of California's construction industry, regulatory compliance is a cornerstone of legitimate operations. Among these regulatory requirements, DIR filing has emerged as a critical process that contractors and subcontractors must navigate when working on public works projects. California's Department of Industrial Relations (DIR) oversees this filing system to ensure fair labor practices, appropriate wage payments, and overall transparency in publicly funded construction projects.

DIR filing encompasses a series of registration procedures, documentation submissions, and ongoing compliance requirements that affect virtually every contractor involved in public works construction. From small subcontractors to large general contractors, understanding and implementing proper DIR filing procedures is not just a legal obligation but also a business necessity that affects project eligibility, payment processing, and professional reputation.

This comprehensive guide explores the essentials of DIR filing in construction, breaking down the registration process, filing requirements, compliance strategies, and potential consequences of non-compliance. Whether you're new to public works projects or looking to refine your existing compliance procedures, this article will provide valuable insights to navigate the DIR filing landscape effectively.

What is a DIR Filing? Who Needs to File DIR

DIR filing refers to the mandatory registration and reporting process established by California's Department of Industrial Relations for contractors and subcontractors working on public works projects. At its core, the DIR filing creates a system of accountability and transparency for projects funded by public money.

The DIR filing system consists of two main components:

- DIR registration - The initial process of registering your business with the Department of Industrial Relations.

- Project reporting - Submitting required documentation for specific public works projects, including the PWC-100 form.

Who needs to register with DIR? The answer is straightforward: any contractor or subcontractor who bids on or performs work on public works projects in California must complete DIR registration.

This includes:

- General contractors

- Specialty contractors

- Subcontractors of any tier

- Joint ventures working on public construction

- Trucking companies performing hauling for public works projects

The requirement applies regardless of the size of your business or the scope of your involvement. Even contractors performing minimal work on a public project must comply with DIR registration requirements. The only exceptions are:

- Material suppliers who do not perform installation

- Contractors working exclusively on projects below the minimum threshold (currently $1,000 for most public works projects)

- Certain federally funded projects with specific exemptions

DIR registration establishes your eligibility to bid on and perform public works projects throughout California. Contractors cannot legally participate in these lucrative opportunities without proper registration, making it an essential step for construction businesses aiming to work in the public sector.

Why DIR Filing Matters in Construction

Compliance with DIR filing requirements carries significant implications beyond mere regulatory checkbox marking. For contractors and subcontractors, proper DIR filing practices impact business operations in several crucial ways:

Legal Project Participation

Without current DIR registration, contractors cannot legally bid on, be awarded, or perform work on public works projects. Awarding bodies must verify all contractors' registration status before allowing project participation.

Payment Processing

Payment applications from contractors without valid DIR registration will typically be rejected. This can create substantial cash flow problems, project delays, and strained business relationships.

Fair Competition

The DIR registration system helps level the playing field by ensuring all contractors adhere to the same labor standards and wage requirements. This prevents unscrupulous contractors from underbidding by skirting labor laws.

Worker Protection

At its foundation, the DIR system exists to protect construction workers by ensuring they receive proper wages and benefits on publicly funded projects. Proper DIR filing supports ethical labor practices industry-wide.

Transparency and Accountability

The public nature of DIR filings allows oversight agencies, competing contractors, and labor organizations to verify compliance with prevailing wage laws and other requirements.

Future Opportunities

Maintaining good standing with DIR through proper DIR filing and compliance preserves your eligibility for future public works projects, which represent billions in potential contract revenue annually.

For project owners and awarding bodies, ensuring contractor compliance with DIR registration requirements protects against project delays, legal complications, and potential liability related to labor violations on their projects.

Step-by-Step Guide to DIR Filing

Navigating the DIR filing process requires attention to detail and adherence to specific timelines. Here's a comprehensive walkthrough of the entire process:

Initial DIR Registration

Step 1: Visit the DIR's Public Works Contractor Registration System online portal.

Step 2: Create a user account if you don't already have one.

Step 3: Complete the DIR registration form with your:

- Business information (legal name, business type, license numbers)

- Contact details

- Workers' compensation insurance information

- Self-certification of eligibility

Step 4: Pay the registration fee (currently $400) via credit card or electronic funds transfer.

Step 5: Submit your application and await approval (typically processed within 1-2 business days).

Upon approval, you'll receive a registration number valid for the current fiscal year (July 1 to June 30).

DIR Registration Renewal

Step 1: Log into your DIR account approximately 90 days before your current registration expires.

Step 2: Verify and update your business information as needed.

Step 3: Complete the DIR registration renewal form.

Step 4: Pay the renewal fee (same as the initial registration fee).

Step 5: Submit your renewal application before June 30 to maintain continuous registration.

Project-Specific Filings

Once registered, contractors must complete project-specific filings for each public works project:

Filing the PWC-100 Form

The PWC-100 form is required at the beginning of every public works project:

Step 1: Awarding bodies (project owners) must file the PWC-100 form within 30 days of contract award.

Step 2: The form must include details about:

- Project information and description

- Contract amounts

- Estimated start and completion dates

- All contractors and subcontractors involved

Contractors should verify their inclusion on the project's PWC-100 form to ensure proper project documentation.

Certified Payroll Reporting

For ongoing compliance during project execution:

Step 1: Maintain detailed payroll records for all workers on public works projects.

Step 2: Submit certified payroll records (CPRs) electronically through the DIR's online system.

Step 3: Submit CPRs at least monthly, though some projects may require more frequent submissions.

Step 4: Maintain copies of all submissions for at least three years after project completion.

Special Circumstances

Joint Ventures: Each participant in a joint venture must have separate DIR registration.

Multiple Business Entities: Companies operating under multiple names or business structures require separate registration for each entity.

Mid-Year Changes: Significant business changes (ownership, address, license numbers) should be updated in your DIR profile promptly.

By following this step-by-step approach, contractors can establish and maintain proper DIR filing compliance throughout the lifecycle of public works projects.

Penalties for Non-Compliance

Failing to meet DIR filing requirements can result in severe consequences for construction contractors. The DIR and related agencies have substantial enforcement powers, and penalties for non-compliance are designed to be significant deterrents:

Bidding Restrictions

Contractors without current DIR registration are prohibited from bidding on, being awarded, or performing work on public works projects. This can instantly eliminate access to billions in potential contract opportunities.

Financial Penalties

- First-time violations for performing work without DIR registration can result in penalties of $2,000 per day up to $10,000

- Willful violations can incur penalties up to $15,000 per day

- Contract-specific penalties may range from $100 to several thousand dollars per violation

Stop Work Orders

The Labor Commissioner can issue stop work orders for projects where contractors are working without proper DIR registration, halting all construction activities until compliance is achieved.

Contract Termination

Awarding bodies may terminate contracts with contractors found to be in violation of DIR registration requirements, which can cause significant financial and reputational damage.

Disbarment

Severe or repeated violations can result in contractors being barred from working on public works projects for 1-3 years.

Legal Action

Beyond administrative penalties, non-compliance can lead to civil lawsuits from regulatory agencies, project owners, or workers affected by violations.

Criminal Prosecution

In cases involving fraud, willful misclassification, or other serious violations, criminal charges may be pursued against company owners or officers.

Retroactive Payments

Contractors found in violation may be required to pay back wages, benefits, and associated penalties for the entire period of non-compliance.

These substantial penalties underscore the importance of maintaining proper DIR registration and filing practices. Many contractors have faced financial hardship or even business closure due to significant non-compliance penalties, making proper DIR filing not just a regulatory requirement but a necessity for business survival.

Best Practices for DIR Compliance

Maintaining consistent compliance with DIR registration requirements requires proactive management and attention to detail. Implementing these best practices can help streamline your DIR filing processes and minimize compliance risks:

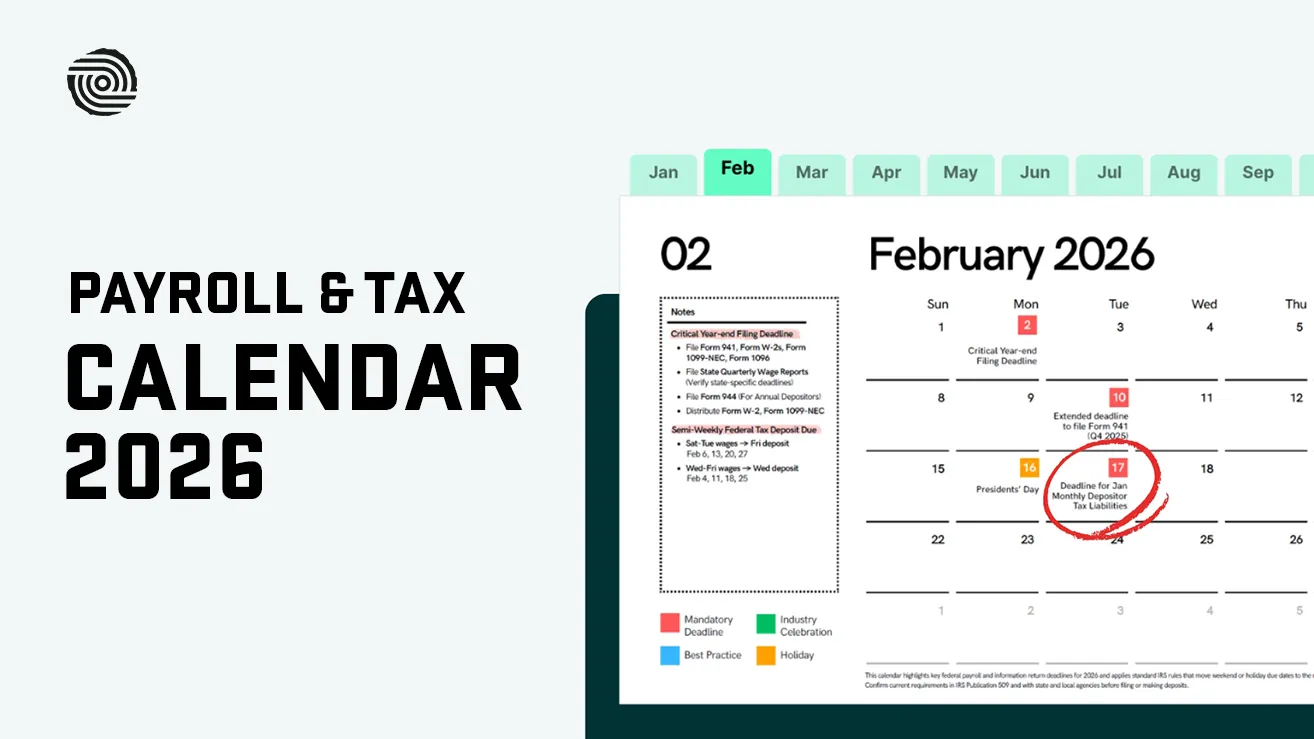

Calendar-Based Management

- Set automatic reminders for DIR registration renewal deadlines (90-120 days before June 30)

- Create project-specific timelines for all required filings

- Schedule regular compliance review meetings with your team

Dedicated Compliance Personnel

- Assign specific staff members the responsibility for DIR compliance

- Invest in training to keep compliance personnel updated on changing regulations

- Consider having a secondary backup person familiar with DIR filing procedures

Systematic Documentation

- Maintain a centralized digital repository for all DIR filings and related documentation

- Implement standardized file naming conventions for easy retrieval

- Keep all registration confirmations, receipts, and correspondence with DIR

- Retain records for a minimum of three years after project completion

Pre-Bid Verification Procedures

- Verify current DIR registration status before bidding on any public works project

- Confirm the registration status of all potential subcontractors

- Include DIR verification as a standard checklist item in bid preparation

Leverage Technology

- Utilize construction-specific compliance software that includes DIR filing capabilities

- Set up automatic alerts for registration expirations

- Consider integrated systems that connect payroll processing with certified payroll reporting

Regular Compliance Audits

- Conduct quarterly internal reviews of DIR compliance documentation

- Periodically verify your public-facing DIR information for accuracy

- Compare actual project practices with documented procedures to identify gaps

Stay Updated on Regulation Changes

- Subscribe to DIR newsletters and updates

- Participate in industry associations that provide compliance updates

- Attend periodic training sessions on public works requirements

Clear Subcontractor Management

- Include DIR requirements in all subcontractor agreements

- Verify subcontractor compliance before processing payments

- Maintain a directory of compliant subcontractors for future projects

Early Communications with Awarding Bodies

- Establish clear communication channels regarding DIR filing with project owners

- Verify PWC-100 form submission by awarding bodies

- Address compliance questions early in the project lifecycle

Implementing these best practices creates a robust compliance framework that minimizes risk while creating operational efficiency around DIR filing requirements.

How Lumber Construction Payroll Service Simplifies DIR Filing

For many contractors, managing DIR filing requirements internally presents significant administrative challenges. Lumber Construction Payroll Service has developed specialized solutions that streamline this complex process, allowing contractors to focus on project execution rather than administrative compliance.

Lumber Construction Payroll Service offers comprehensive support for every aspect of DIR filing:

Registration Management

- Assistance with completing and submitting the DIR registration form

- Documentation management for registration confirmation and related correspondence

Project Documentation Support

- Verification of proper PWC-100 form filing by awarding bodies

- Confirmation of project inclusion in DIR databases

- Integration of project-specific requirements into compliance processes

Certified Payroll Reporting

- Automated generation of compliant certified payroll reports

- Electronic submission to DIR systems

- Built-in validation to catch common reporting errors

- Secure storage of all submitted reports

- Custom reporting for internal tracking and management

Integrated Compliance Solutions

- Seamless connection between payroll processing and DIR reporting

- Subcontractor compliance tracking and management

- Customized alerting for potential compliance issues

Regulatory Updates and Training

- Regular updates on changing DIR registration requirements

- Training for contractor personnel on compliance procedures

- Access to compliance experts for complex questions

- Documentation of compliance best practices

By partnering with Lumber Construction Payroll Service, contractors can transform DIR filing from a burdensome administrative process into a streamlined operational component. This allows for the reallocation of internal resources toward core business activities while reducing compliance risks and penalties.

The service's specialized focus on construction payroll ensures that all DIR submissions meet the specific requirements of construction projects, addressing industry-specific challenges that generic payroll providers might miss.

Effective DIR filing is no longer optional for contractors in California's public works construction. As regulatory oversight increases and penalties for non-compliance grow steeper, maintaining proper DIR registration has become a fundamental business practice rather than an administrative afterthought.

Throughout this guide, we've explored the essential components of DIR filing, from initial DIR registration to ongoing compliance requirements and best practices. Key takeaways include:

- DIR registration is mandatory for virtually all contractors and subcontractors on public works projects

- The registration process involves specific steps and documentation, including the DIR registration form

- Annual DIR registration renewal is required to maintain eligibility for public works projects

- Project-specific documentation, including the PWC-100 form, must be properly filed and maintained

- Non-compliance penalties can be severe, potentially threatening business viability

- Implementing systematic compliance practices significantly reduces the risk

- Third-party services like Lumber Construction Payroll Service can provide valuable compliance support

As California's construction industry continues to evolve, DIR filing requirements may change, requiring ongoing attention and adaptation from contractors. However, the fundamental principles of transparency, fair labor practices, and regulatory compliance will remain central to successful participation in public works construction.

By approaching DIR filing as a strategic business function rather than a bureaucratic burden, contractors can protect their eligibility for lucrative public projects while contributing to a construction industry built on fair competition and ethical labor practices.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec ullamcorper mattis lorem non. Ultrices praesent amet ipsum justo massa. Eu dolor aliquet risus gravida nunc at feugiat consequat purus. Non massa enim vitae duis mattis. Vel in ultricies vel fringilla.

Introduction

Mi tincidunt elit, id quisque ligula ac diam, amet. Vel etiam suspendisse morbi eleifend faucibus eget vestibulum felis. Dictum quis montes, sit sit. Tellus aliquam enim urna, etiam. Mauris posuere vulputate arcu amet, vitae nisi, tellus tincidunt. At feugiat sapien varius id.

Eget quis mi enim, leo lacinia pharetra, semper. Eget in volutpat mollis at volutpat lectus velit, sed auctor. Porttitor fames arcu quis fusce augue enim. Quis at habitant diam at. Suscipit tristique risus, at donec. In turpis vel et quam imperdiet. Ipsum molestie aliquet sodales id est ac volutpat.

Ipsum sit mattis nulla quam nulla. Gravida id gravida ac enim mauris id. Non pellentesque congue eget consectetur turpis. Sapien, dictum molestie sem tempor. Diam elit, orci, tincidunt aenean tempus. Quis velit eget ut tortor tellus. Sed vel, congue felis elit erat nam nibh orci.

Dolor enim eu tortor urna sed duis nulla. Aliquam vestibulum, nulla odio nisl vitae. In aliquet pellentesque aenean hac vestibulum turpis mi bibendum diam. Tempor integer aliquam in vitae malesuada fringilla.

Elit nisi in eleifend sed nisi. Pulvinar at orci, proin imperdiet commodo consectetur convallis risus. Sed condimentum enim dignissim adipiscing faucibus consequat, urna. Viverra purus et erat auctor aliquam. Risus, volutpat vulputate posuere purus sit congue convallis aliquet. Arcu id augue ut feugiat donec porttitor neque. Mauris, neque ultricies eu vestibulum, bibendum quam lorem id. Dolor lacus, eget nunc lectus in tellus, pharetra, porttitor.

Ipsum sit mattis nulla quam nulla. Gravida id gravida ac enim mauris id. Non pellentesque congue eget consectetur turpis. Sapien, dictum molestie sem tempor. Diam elit, orci, tincidunt aenean tempus. Quis velit eget ut tortor tellus. Sed vel, congue felis elit erat nam nibh orci.

Mi tincidunt elit, id quisque ligula ac diam, amet. Vel etiam suspendisse morbi eleifend faucibus eget vestibulum felis. Dictum quis montes, sit sit. Tellus aliquam enim urna, etiam. Mauris posuere vulputate arcu amet, vitae nisi, tellus tincidunt. At feugiat sapien varius id.

Eget quis mi enim, leo lacinia pharetra, semper. Eget in volutpat mollis at volutpat lectus velit, sed auctor. Porttitor fames arcu quis fusce augue enim. Quis at habitant diam at. Suscipit tristique risus, at donec. In turpis vel et quam imperdiet. Ipsum molestie aliquet sodales id est ac volutpat.

Mi tincidunt elit, id quisque ligula ac diam, amet. Vel etiam suspendisse morbi eleifend faucibus eget vestibulum felis. Dictum quis montes, sit sit. Tellus aliquam enim urna, etiam. Mauris posuere vulputate arcu amet, vitae nisi, tellus tincidunt. At feugiat sapien varius id.

Eget quis mi enim, leo lacinia pharetra, semper. Eget in volutpat mollis at volutpat lectus velit, sed auctor. Porttitor fames arcu quis fusce augue enim. Quis at habitant diam at. Suscipit tristique risus, at donec. In turpis vel et quam imperdiet. Ipsum molestie aliquet sodales id est ac volutpat.

- Lectus id duis vitae porttitor enim gravida morbi.

- Eu turpis posuere semper feugiat volutpat elit, ultrices suspendisse. Auctor vel in vitae placerat.

- Suspendisse maecenas ac donec scelerisque diam sed est duis purus.

Lectus leo massa amet posuere. Malesuada mattis non convallis quisque. Libero sit et imperdiet bibendum quisque dictum vestibulum in non. Pretium ultricies tempor non est diam. Enim ut enim amet amet integer cursus. Sit ac commodo pretium sed etiam turpis suspendisse at.

Tristique odio senectus nam posuere ornare leo metus, ultricies. Blandit duis ultricies vulputate morbi feugiat cras placerat elit. Aliquam tellus lorem sed ac. Montes, sed mattis pellentesque suscipit accumsan. Cursus viverra aenean magna risus elementum faucibus molestie pellentesque. Arcu ultricies sed mauris vestibulum.

Critical Construction Compliance | Awareness Week

Mar 16, 2026

Apr 15, 2026

Nov 30, 2026

Dec 15, 2026

Essential resources for contractors

.webp)