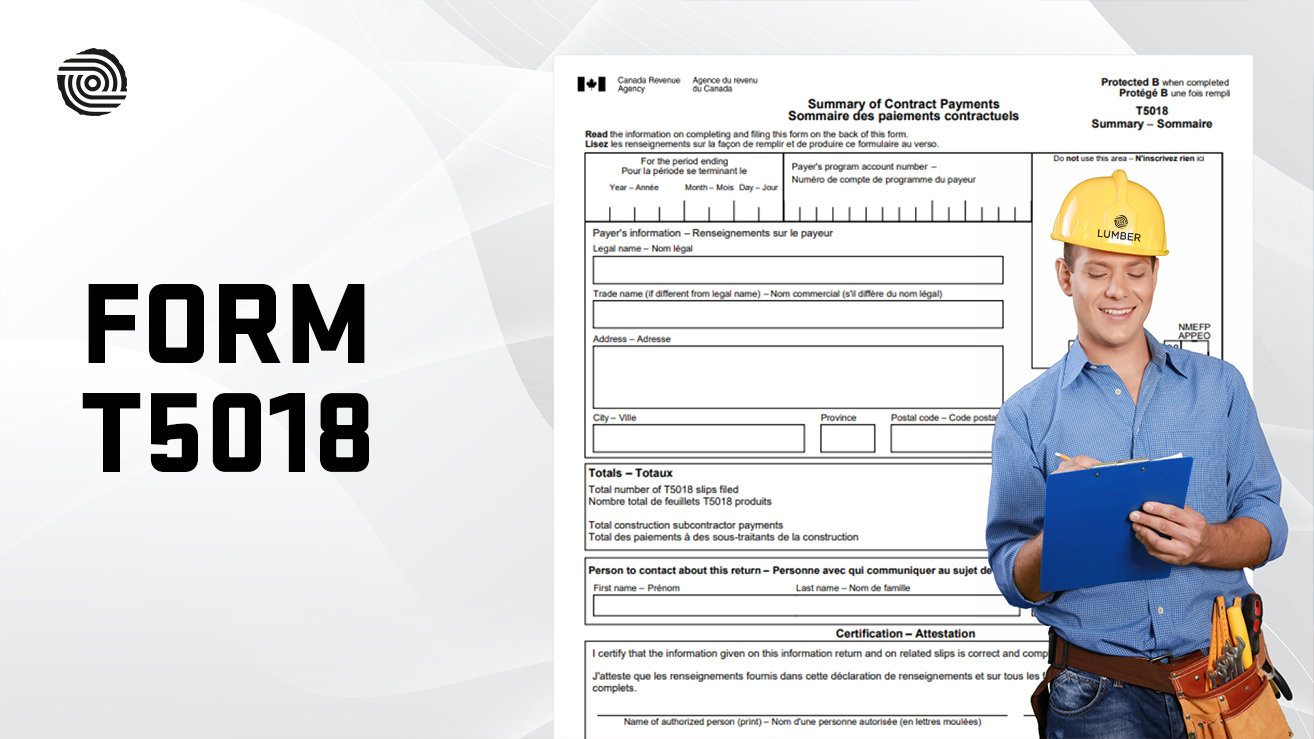

How to File Your T5018 Form: A Comprehensive Guide

In the Canadian construction industry, compliance with tax reporting requirements is essential to maintain transparency and avoid penalties. One crucial tax document for construction companies is the T5018 form, also known as the Statement of Contract Payments. This form is used to report payments made to subcontractors for construction services.

Filing the T5018 accurately helps the Canada Revenue Agency (CRA) track contract payments and ensures that subcontractors report their income correctly, reducing the risk of tax evasion and activities in the underground economy. This guide provides a detailed overview of the T5018 form, its purpose, filing requirements, and practical tips for Canadian construction businesses.

What is T5018?

The T5018 form is a tax slip required by the CRA for businesses involved in construction activities where more than 50% of the business income is derived from construction. It is used to report the total contract payments made to subcontractors within a calendar or fiscal year. The form serves as a formal record of payments to subcontractors for construction services, including those made via cash, cheque, barter, or other exchanges.

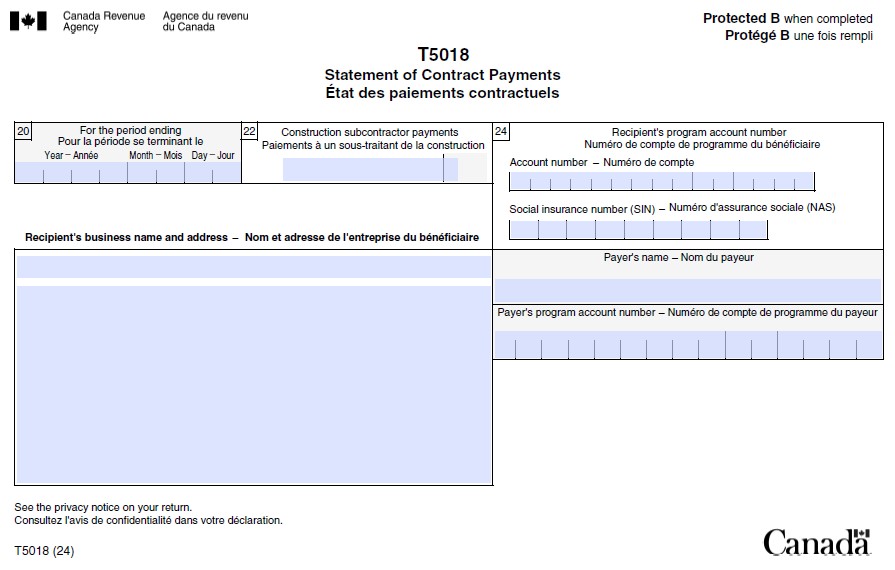

This form consists of two parts: the T5018 slips issued to each subcontractor and the T5018 summary, which aggregates the total payments reported on all slips submitted. The T5018 form supports CRA efforts to monitor construction industry payments and reduce unreported income.

What is a T5018 Form Used for in the Construction Sector?

The T5018 form is specifically designed for construction companies to report payments made to subcontractors for services, such as excavation, site preparation, carpentry, plumbing, electrical work, landscaping, and other construction-related tasks. The form's primary purpose is to provide the CRA with accurate data on these payments to ensure subcontractors report their earnings and comply with tax obligations.

Given the unique nature of construction work, which often involves numerous subcontractors and complex payment arrangements, the T5018 form helps maintain transparency in subcontractor payments and prevents income understatement within the industry. The CRA uses the information collected through these forms to cross-check income declarations, thus safeguarding the tax base.

Key Differences Between the T5018 Form and T4A Form

Understanding when to file a T5018 versus a T4A is crucial for construction businesses. While both are tax information returns, they serve different purposes and apply under different circumstances:

- T5018: Used primarily for reporting payments made to subcontractors for construction services when construction activities represent the core business income (over 50%). It reports contract payments to individuals, partnerships, trusts, and corporations engaged in construction.

- T4A: Generally filed to report other types of payments not related directly to subcontracted construction services, including commissions, fees for services, or payments to contractors where construction is not the primary business activity.

In cases where a subcontractor performs services as an employee and also provides subcontracted services, the employment income should be reported on a T4 slip while the subcontracted work is reported on a T5018. Non-resident subcontractors, meanwhile, are reported via T4A-NR forms.

5 W’s of the T5018 Form: Understanding the T5018 Requirements

Who Needs to File the T5018?

Any individual, partnership, trust, or corporation in Canada whose primary source of business income (more than 50%) comes from construction activities and who has made total payments exceeding $500 to subcontractors for construction services within the year must file the T5018 slip. This includes businesses operating inside or outside Canada that pay Canadian resident subcontractors for construction work.

What Do I Need to Prepare to File the T5018?

To file the T5018, the following key information must be gathered:

- Total payments made to each subcontractor for construction services (excluding GST/HST)

- Subcontractor’s legal name, address, and Business Number or Social Insurance Number

- Payment period end date (calendar or fiscal year)

- Payer’s (your business) name, address, and program account number

- Detailed services provided and location of the work (as required)

- Authorized person’s details for the summary submission

These details ensure accurate reporting and complete disclosure to the CRA.

When Does the T5018 Need to Be Filed?

The submission deadline for the T5018 form and its summary is six months after the end of the fiscal year or calendar year used for reporting. For example, if your fiscal year ends on December 31, the filing deadline would be the last day of June the following year. Late filings may incur penalties and interest charges determined by the CRA.

Where to Submit the T5018 Tax Form?

Businesses with fewer than 50 T5018 slips can file the form either electronically via CRA Web Forms or by paper mail. Paper submissions should be sent to the appropriate CRA tax center, such as Revenue Canada Jonquière TC in Quebec. Businesses preparing 50 or more T5018 slips are required to file electronically, either via XML upload or CRA Web Forms, to streamline processing.

Why is the T5018 Important for Construction Companies?

The T5018 form is vital for maintaining compliance with Canadian tax regulations in the construction sector. It helps prevent tax evasion by ensuring all subcontractor payments are reported. Accurate T5018 filing supports the CRA’s monitoring of income in the industry, helps subcontractors correctly report income on their tax returns, reduces risks of audits, penalties, and interest, and promotes trust and transparency between contractors, subcontractors, and the tax authorities.

Consequences of Incorrect T5018 Filing

Failure to file the T5018 form correctly or on time can lead to significant penalties imposed by the CRA. These can include late filing fees, interest on outstanding amounts, and in some cases, audits or reassessments of tax returns for both the payer and subcontractors. Inaccurate or incomplete T5018 information can also trigger compliance reviews that may disrupt business operations. Therefore, precise and timely reporting is essential to avoid financial and legal complications.

Exemptions: Who Does NOT Need to File the T5018?

Not all businesses or payments require T5018 reporting. Exemptions include:

- Businesses where construction activities do not exceed 50% of total income.

- Payments made solely for materials or goods (not services).

- Payments to non-resident subcontractors must be reported using the T4A-NR form instead.

- Businesses that make less than $500 in payments to subcontractors during the year.

- Employees paid through payroll services reported on T4 slips rather than subcontractors.

The T5018 form is a critical compliance document for Canadian construction companies, ensuring transparency and accountability in payments to subcontractors. Filing this form accurately and on time protects businesses from penalties and supports a fair tax system. Construction companies must understand when and how to file the T5018, what information to report, and the differences from other tax forms like the T4A. Proper T5018 management ultimately helps maintain good standing with the CRA and fosters trust within the construction ecosystem.

Frequently Asked Questions

Do I need to file a T5018 for all subcontractors?

You must file a T5018 slip for subcontractors when payments for construction services exceed $500 within the fiscal or calendar year. Payments below this threshold or for materials only do not require T5018 reporting.

Is the T5018 filing deadline the same for all businesses?

Yes, the deadline to file the T5018 form is generally six months after your fiscal year-end or calendar year-end, regardless of business size. Larger filers (50+ slips) must file electronically.

How do I file T5018 electronically?

Businesses with 50 or more slips must file electronically using either XML file submission through CRA's Filing Information Returns Electronically (FIRE) system or CRA Web Forms. Smaller businesses have the option to file electronically or by mail.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec ullamcorper mattis lorem non. Ultrices praesent amet ipsum justo massa. Eu dolor aliquet risus gravida nunc at feugiat consequat purus. Non massa enim vitae duis mattis. Vel in ultricies vel fringilla.

Introduction

Mi tincidunt elit, id quisque ligula ac diam, amet. Vel etiam suspendisse morbi eleifend faucibus eget vestibulum felis. Dictum quis montes, sit sit. Tellus aliquam enim urna, etiam. Mauris posuere vulputate arcu amet, vitae nisi, tellus tincidunt. At feugiat sapien varius id.

Eget quis mi enim, leo lacinia pharetra, semper. Eget in volutpat mollis at volutpat lectus velit, sed auctor. Porttitor fames arcu quis fusce augue enim. Quis at habitant diam at. Suscipit tristique risus, at donec. In turpis vel et quam imperdiet. Ipsum molestie aliquet sodales id est ac volutpat.

Ipsum sit mattis nulla quam nulla. Gravida id gravida ac enim mauris id. Non pellentesque congue eget consectetur turpis. Sapien, dictum molestie sem tempor. Diam elit, orci, tincidunt aenean tempus. Quis velit eget ut tortor tellus. Sed vel, congue felis elit erat nam nibh orci.

Dolor enim eu tortor urna sed duis nulla. Aliquam vestibulum, nulla odio nisl vitae. In aliquet pellentesque aenean hac vestibulum turpis mi bibendum diam. Tempor integer aliquam in vitae malesuada fringilla.

Elit nisi in eleifend sed nisi. Pulvinar at orci, proin imperdiet commodo consectetur convallis risus. Sed condimentum enim dignissim adipiscing faucibus consequat, urna. Viverra purus et erat auctor aliquam. Risus, volutpat vulputate posuere purus sit congue convallis aliquet. Arcu id augue ut feugiat donec porttitor neque. Mauris, neque ultricies eu vestibulum, bibendum quam lorem id. Dolor lacus, eget nunc lectus in tellus, pharetra, porttitor.

Ipsum sit mattis nulla quam nulla. Gravida id gravida ac enim mauris id. Non pellentesque congue eget consectetur turpis. Sapien, dictum molestie sem tempor. Diam elit, orci, tincidunt aenean tempus. Quis velit eget ut tortor tellus. Sed vel, congue felis elit erat nam nibh orci.

Mi tincidunt elit, id quisque ligula ac diam, amet. Vel etiam suspendisse morbi eleifend faucibus eget vestibulum felis. Dictum quis montes, sit sit. Tellus aliquam enim urna, etiam. Mauris posuere vulputate arcu amet, vitae nisi, tellus tincidunt. At feugiat sapien varius id.

Eget quis mi enim, leo lacinia pharetra, semper. Eget in volutpat mollis at volutpat lectus velit, sed auctor. Porttitor fames arcu quis fusce augue enim. Quis at habitant diam at. Suscipit tristique risus, at donec. In turpis vel et quam imperdiet. Ipsum molestie aliquet sodales id est ac volutpat.

Mi tincidunt elit, id quisque ligula ac diam, amet. Vel etiam suspendisse morbi eleifend faucibus eget vestibulum felis. Dictum quis montes, sit sit. Tellus aliquam enim urna, etiam. Mauris posuere vulputate arcu amet, vitae nisi, tellus tincidunt. At feugiat sapien varius id.

Eget quis mi enim, leo lacinia pharetra, semper. Eget in volutpat mollis at volutpat lectus velit, sed auctor. Porttitor fames arcu quis fusce augue enim. Quis at habitant diam at. Suscipit tristique risus, at donec. In turpis vel et quam imperdiet. Ipsum molestie aliquet sodales id est ac volutpat.

- Lectus id duis vitae porttitor enim gravida morbi.

- Eu turpis posuere semper feugiat volutpat elit, ultrices suspendisse. Auctor vel in vitae placerat.

- Suspendisse maecenas ac donec scelerisque diam sed est duis purus.

Lectus leo massa amet posuere. Malesuada mattis non convallis quisque. Libero sit et imperdiet bibendum quisque dictum vestibulum in non. Pretium ultricies tempor non est diam. Enim ut enim amet amet integer cursus. Sit ac commodo pretium sed etiam turpis suspendisse at.

Tristique odio senectus nam posuere ornare leo metus, ultricies. Blandit duis ultricies vulputate morbi feugiat cras placerat elit. Aliquam tellus lorem sed ac. Montes, sed mattis pellentesque suscipit accumsan. Cursus viverra aenean magna risus elementum faucibus molestie pellentesque. Arcu ultricies sed mauris vestibulum.

Critical Construction Compliance | Awareness Week

Mar 16, 2026

Apr 15, 2026

Nov 30, 2026

Dec 15, 2026

Essential resources for contractors